how much is inheritance tax in nc

Currently federal law exempts 1118 million in inheritance tax from inheritance tax. However this is five percent of the value after all debts have been paid.

How To Calculate Inheritance Tax 12 Steps With Pictures

No Inheritance Tax in NC.

. For example lets say a family member passes away in an area with a 5 estate tax. Skip to main content Menu. No Inheritance Tax in NC.

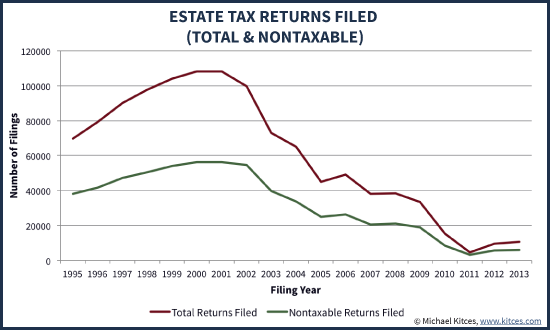

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. If the tax rate for a 40000 inheritance is 10 then you as the taxpayer would owe 4000 in taxes on that inheritance. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all.

The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. However there are sometimes taxes for other reasons. However state residents should remember to take into account the federal estate tax if their estate or the.

North Carolina does not collect an inheritance tax or an estate tax. However there are sometimes taxes for other reasons. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate.

Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. North Carolina does not collect an inheritance tax or an estate tax. There is no inheritance tax in North Carolina.

Elliot Marks Author Social Security Advisor. The major difference between estate tax and inheritance tax is who pays the tax. Items included in the.

States With No Income Tax Or Estate Tax The states with. The estate tax is paid based on the. Inheritance Tax in North Carolina.

If you inherit property. Other forms of retirement income are taxed at the North Carolina flat income tax rate of 525. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from. An inheritance tax is usually paid by a person inheriting an estate. There is no federal inheritance tax but there is a federal estate tax.

According to the new 10-year payout. According to the law an executor can receive up to five percent of the value of the estate for compensation. Initiatives were floated to repeal Nebraskas inheritance tax and North Carolinas estate tax in 2012 but nothing happened on this front in Nebraska.

If you live in a state that does have an estate tax you may be expected to pay the death. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. The inheritance tax of another state may come into play for those living in North Carolina who inherit money.

State inheritance tax rates range from 1 up to 16. These are some of the taxes you may have to think about as an heir. The top inheritance tax rate is 16 percent no.

For Tax Year 2019 For Tax. Which states have no estate tax. However state residents should remember to take into account the federal estate tax if their estate or the.

North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a. However there are 2 important exceptions to this rule.

Home File Pay. There is no inheritance tax in NC. North Carolinas estate tax.

Tax Rate Schedules. A surviving spouse is the only person exempt from paying this tax. This means that anything under 1118 million is not subject to tax if you inherit it.

And it also means that if you inherit more than 1118 million you only have to pay inheritance tax on the portion that exceeds that limit.

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

New York Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Estate And Gift Taxes Offit Kurman

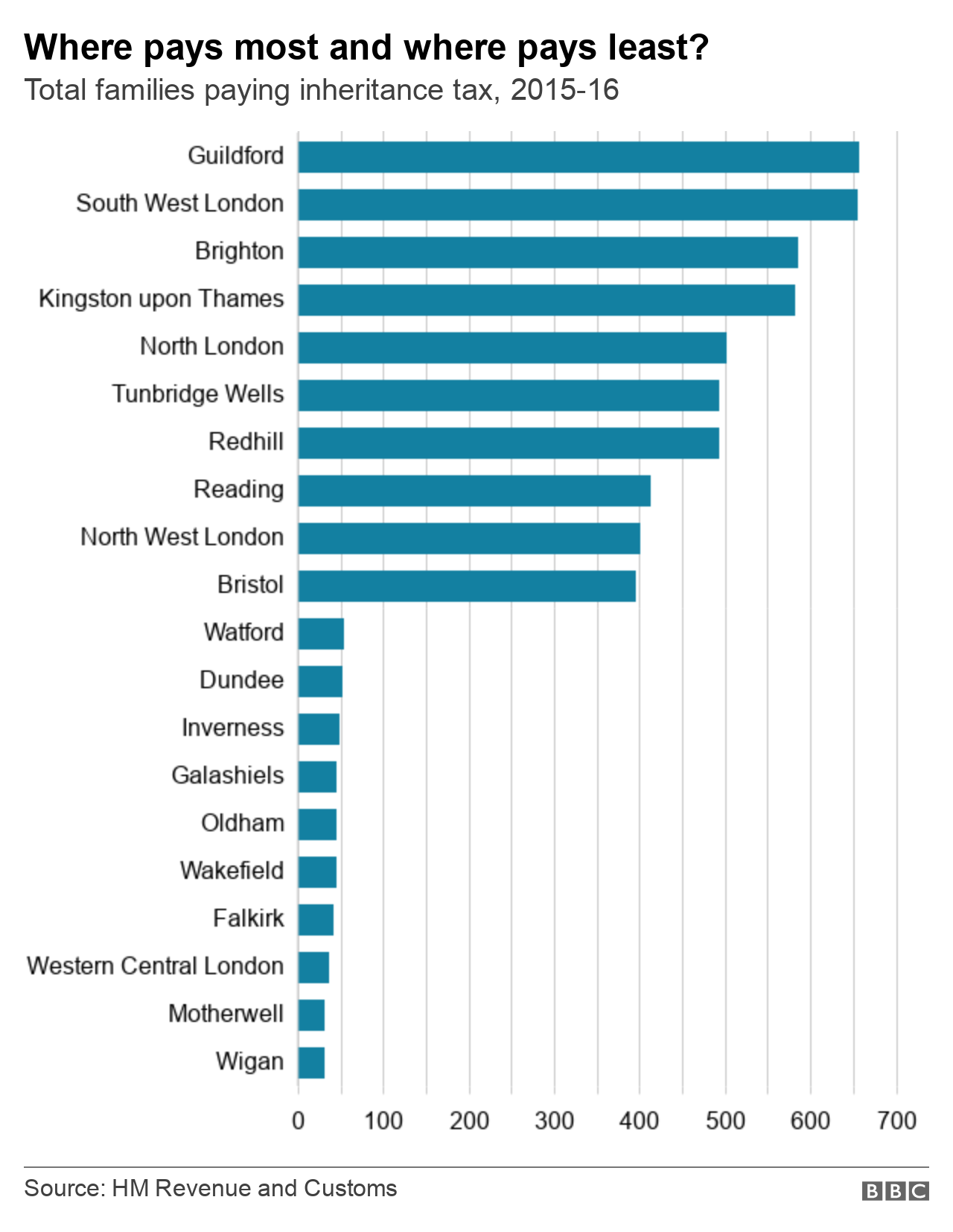

Guildford Is The Inheritance Tax Capital Of The Uk Bbc News

Is There A Federal Inheritance Tax Legalzoom Com

Taxes On Your Inheritance In California Albertson Davidson Llp

401 K Inheritance Tax Rules Estate Planning

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Jersey Supreme Court Clarifies Transfer Inheritance Tax

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Calculating Inheritance Tax Laws Com

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Federal Gift Tax Vs California Inheritance Tax

New Irs Requirements To Request Estate Closing Letter

Eight Things You Need To Know About The Death Tax Before You Die